Decline in the inequality of Bank account ownerships in India

The percentage of adults having bank account ownership is an important indicator to understand the financial penetration in an economy. The access to the financial world will help the individuals of an economy to transact and manage money through savings, investments, making payments, and borrowing which would further enhance their financial well-being. Access to the bank account is the first step in this process but to ensure that the needs are met, it is vital to improve the financial literacy and at the same time reduce the inequality that persists and strategically expand the activities of financial inclusion.

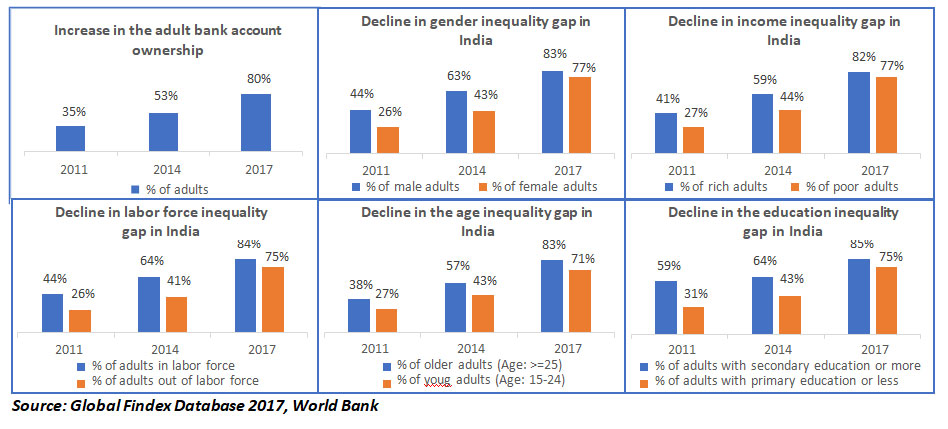

Globally, there is a rise in financial inclusion. As per the World Bank’s Global Findex database 2017, over 80% of the adult population in India have bank account ownership and the rest 20% are unbanked. Among the 80% of the banked population in India, the inequality gap persists. However, the data reveals that there is a drastic decline in the inequality gaps of the bank account ownerships in India.

- Adult men have a higher percentage of bank account ownership compared to adult women. The gender inequality gap has shrunk in India from 18% in the year 2011 to 6% as of

- Adults among the richest 60% of the population have higher percentage of bank account ownership compared to the adults among the poorest 40% of the population. The income inequality gap between rich and the poor in India has reduced from 14% in the year 2011 to 5% as of

- Adults in the labor force have a higher percentage of bank account ownership compared to the adults out of the labor force. The labor force inequality gap has reduced from 18% in the year 2011 to 9% in the year

- Older adults (Age >=25) have a higher percentage of financial account ownership than the Young adults (Age between 15-24). The age inequality gap has increased from 11% in the year 2011 to 14% in the year 2014 and then declined to 12% as of

- Adults with secondary education or more have a higher percentage of bank account ownership than adults with primary education or less. The education inequality gap has reduced from 28% in the year 2011 to 10% in the year

Cheers to the Government of India, an increase in the bank account ownership and decline in the inequality gaps has become possible because of the focused financial education and financial inclusion initiatives. The likelihood of banking the unbanked and further decline in the inequality gaps in India is higher in the future report of Global Findex database due to the recent financial inclusion initiatives such as National Strategy for Financial Education (NSFE) 2020-2025 , Pradhan Mantri Jan-Dhan Yojana (PMJDY), social security schemes viz. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), Pradhan Mantri Kisan Maan Dhan Yojana (PM-KMY), Pradhan Mantri Shram Yogi Maan Dhan Yojana (PM-SYM) and Pradhan Mantri Mudra Yojana (PMMY) that are trying to bring the excluded sections into the financial mainstream.

In the face of the challenges due to COVID-19 pandemic, ensuring effective implementation of the financial inclusion initiatives, monitoring and expanding the reach of the financial education initiatives, and deeper penetration of mobile and internet access should be the key areas of focus for the regulators and the Government of India.

Dr. Muneer Shaik is an Assistant Professor at Mahindra University, School of Management, Hyderabad.